The Significance of "mei paga iss?" in Financial Services

The phrase "mei paga iss?", which translates to "Where is my money?" in the fictional Dothraki language, encapsulates a fundamental concern that transcends the world of fantasy and resonates deeply in the realm of financial services. In today's fast-paced business environment, understanding financial health is crucial for entrepreneurs, accountants, and financial service providers alike. This article explores the implications of this phrase within the context of managing finances, ensuring compliance, and optimizing cash flow for small and medium enterprises (SMEs).

The Importance of Cash Flow in Business Operations

For any business, particularly SMEs, the question of "Where is my money?" often boils down to cash flow management. Cash flow refers to the movement of money in and out of a business and is essential for covering expenses, funding growth, and ensuring operational stability. Here are some key points regarding cash flow:

- Liquidity: Adequate cash flow ensures that a business remains liquid, meaning it has enough cash on hand to meet its short-term obligations.

- Operational Efficiency: Regular cash flow monitoring helps businesses identify any discrepancies in income and expenses, allowing for proactive management.

- Growth Opportunities: Positive cash flow provides the funds necessary for investments in new projects, equipment, and talent.

- Financial Health: Investors and creditors often examine cash flow statements to assess the financial health of a business.

Understanding Tax Obligations: A Guide for SMEs

Tax obligations are a significant aspect of the financial services realm. Understanding and managing these obligations can prevent your business from suffering penalties and losing money. Here’s what you need to know:

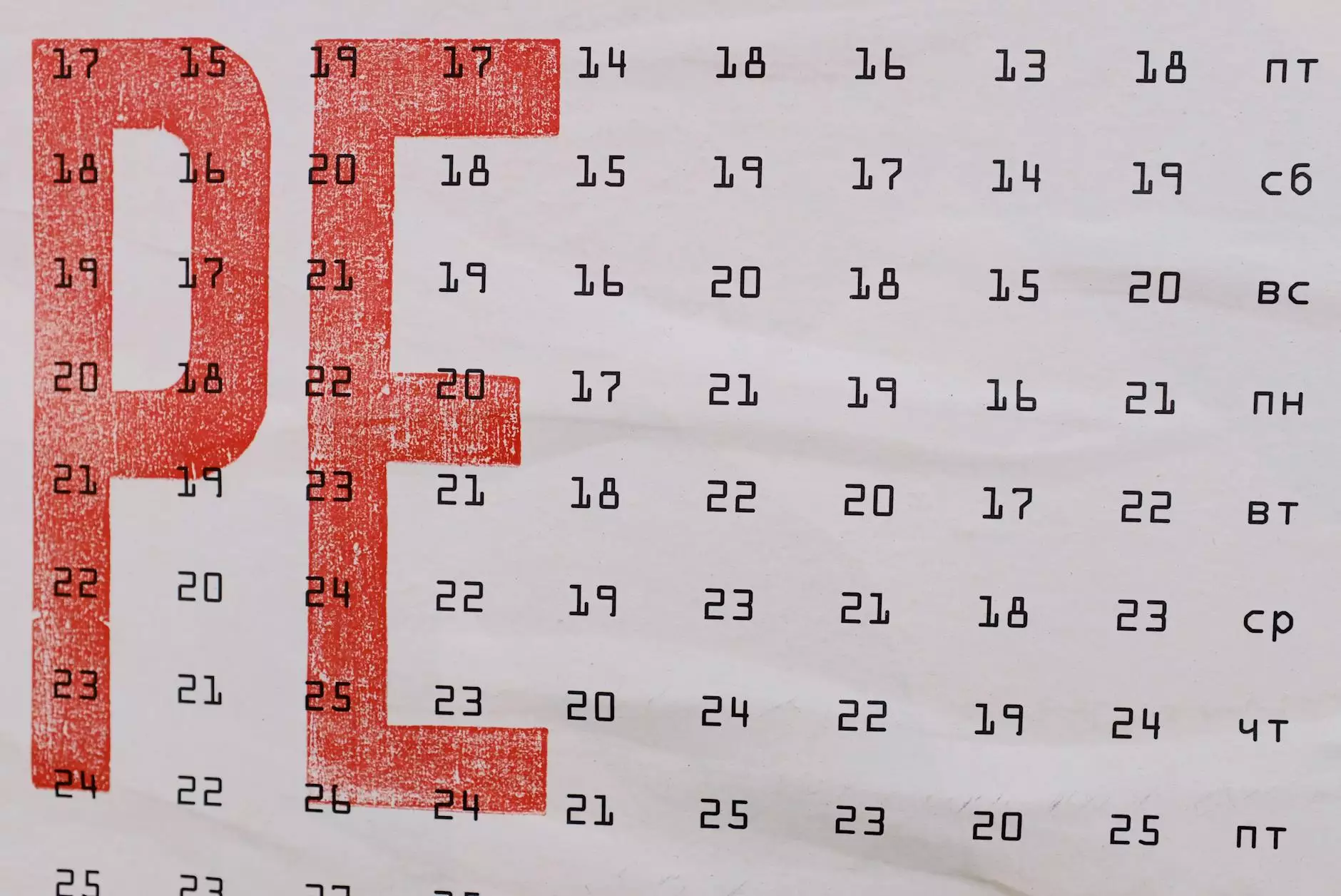

What is ISS?

ISS, or Imposto Sobre Serviços, is a tax levied on services provided in Brazil. As a business owner, it is crucial to understand your responsibilities regarding this tax. For small businesses, particularly those registered under the MEI (Microempreendedor Individual) scheme, compliance can be complex:

- MEI Registration: Ensure your business is registered as an MEI to benefit from simplified tax obligations.

- Tax Rates: Understand the ISS tax rates applicable to the specific services you offer. This knowledge helps in pricing your services correctly.

- Regular Filings: Keep up with regular tax filings to avoid unnecessary fines. Understanding when and how to file can make a significant difference.

How to Manage Your Finances Effectively

To answer the question "mei paga iss?", business owners must implement effective financial management strategies. Below are comprehensive steps to enhance your financial workings:

1. Create a Robust Budget

Establishing a detailed budget is the cornerstone of financial management. A precise budget helps track income, predict expenses, and adjust accordingly. Here’s how to build one:

- Analyze Past Expenses: Look at previous spending to project future costs more accurately.

- Include Fixed and Variable Costs: Make sure to account for both fixed (e.g., rent, salaries) and variable costs (e.g., materials, utility bills).

- Monitor Regularly: Regularly reviewing the budget helps keep spending in check and identifies trends that may need adjustment.

2. Implement Efficient Invoicing Systems

To maintain a steady cash flow, businesses must prioritize timely invoicing:

- Use Automated Tools: Leveraging invoicing software can reduce manual errors and ensure quick billing.

- Set Clear Payment Terms: Clearly outline terms of service and payment deadlines to facilitate prompt payments.

- Follow Up on Outstanding Payments: Don't hesitate to follow up with clients about overdue invoices. A gentle reminder can often resolve payment delays.

3. Diversify Revenue Streams

Having multiple revenue streams can protect your business from financial instability. Consider these strategies:

- Expand Services: If you're a service-based business, think about what additional services you could offer to your clients.

- Market to New Segments: Target other demographics or industries that may benefit from your services.

- Invest in Digital Solutions: Develop an online presence to reach a broader audience, thereby increasing potential income.

Navigating Financial Regulations and Compliance

To ensure financial viability, it's paramount to navigate the regulatory landscape effectively. Regulations can be daunting, but understanding them is crucial:

- Stay Informed: Regularly educate yourself about changes in tax laws, regulations, and compliance requirements by following trusted financial news sources.

- Hire a Qualified Accountant: Engage with accounting professionals who can guide you through complex tax scenarios and ensure compliance.

- Utilize Technology: Accounting and financial management software can simplify compliance, making it easier to manage financial records and reports.

The Role of Financial Service Providers

Financial service providers play a crucial role in supporting SMEs. They help businesses interpret financial data, manage cash flow, and navigate tax obligations. Here’s how they can assist:

Consultation and Advice

Providers offer tailored advice specific to your industry, helping you make informed decisions. This can include:

- Establishing Financial Goals: Helping define short-term and long-term financial goals based on your unique business needs.

- Maximizing Tax Deductions: Providing insights into eligible business deductions to optimize tax obligations.

- Financial Forecasting: Assisting in creating forecasts that anticipate future income and expenses, supporting strategic planning.

Streamlined Accounting Services

Outsourcing accounting tasks can free up time for business owners to focus on core operations:

- Bookkeeping: Regular bookkeeping ensures accurate financial records and pays attention to cash flow.

- Tax Preparation: Professional accountants can prepare your taxes, relieving the stress of compliance.

- Payroll Management: Efficient payroll systems ensure that employee salaries are processed accurately and on time.

Conclusion: Empowering Your Business with Financial Knowledge

In conclusion, understanding the question "mei paga iss?" represents more than just a curiosity; it highlights the critical importance of managing your financial situation effectively. With proper cash flow management, awareness of tax obligations like the ISS, and the support of professional financial service providers, businesses can thrive in a competitive landscape. By implementing the strategies outlined in this article, you can safeguard your financial health, seize growth opportunities, and navigate the complexities of running a successful business.

Investing in your financial literacy can be one of the most beneficial decisions you make as a business owner. After all, knowing where your money is located is not just a question—it's a pathway to success.